I. Introduction

DeFi risks are something you can not ignore if you have an interest in Crypto. Decentralized Finance, often referred to as DeFi, is a revolutionary movement within the cryptocurrency and blockchain space that aims to recreate traditional financial services using blockchain technology and smart contracts. Unlike traditional finance, which relies on intermediaries like banks, DeFi platforms enable users to access financial services directly, peer-to-peer, without the need for intermediaries. These services include lending, borrowing, trading, yield farming, and more, all powered by smart contracts on blockchain networks like Ethereum.

Growing Popularity of DeFi Platforms

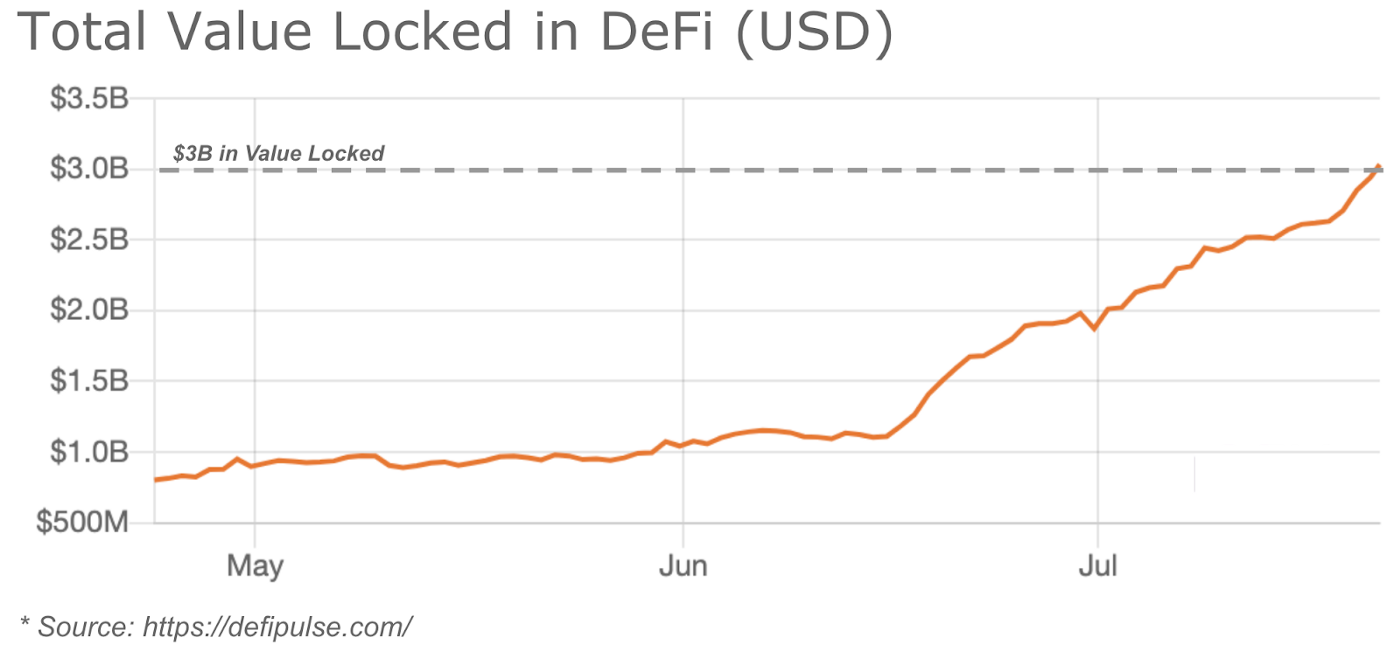

DeFi has gained significant traction over the past few years, with a multitude of platforms and protocols emerging. The total value locked (TVL) in DeFi platforms has surged into billions of dollars, showcasing the growing interest and adoption among users seeking more accessible and inclusive financial services. The rapid growth of DeFi platforms has also led to innovative use cases, financial experiments, and new investment opportunities.

You will also like: Web3 Marketing Strategies: Era of Blockchain-Based Advertising

Read More: Blockchain Boost: Effective Marketing for Crypto Projects

Importance of Understanding and Managing Risks

While DeFi offers promising opportunities, it’s crucial for investors and users to recognize that these platforms come with inherent risks. DeFi operates in a relatively nascent and rapidly evolving ecosystem, which can expose users to various vulnerabilities. Understanding and managing these risks are paramount to protecting one’s investments and ensuring a safer participation in the DeFi space. Failing to assess and address risks adequately can result in financial loss, security breaches, and other undesirable outcomes.

II. Types of Risks in DeFi

A. Smart Contract Risks

- Explanation of Smart Contracts in DeFi

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. In DeFi, smart contracts automate and enforce financial agreements, removing the need for intermediaries. They enable various functions, such as automated lending, trading, and yield farming, based on predefined conditions. - Vulnerabilities and Potential Exploits

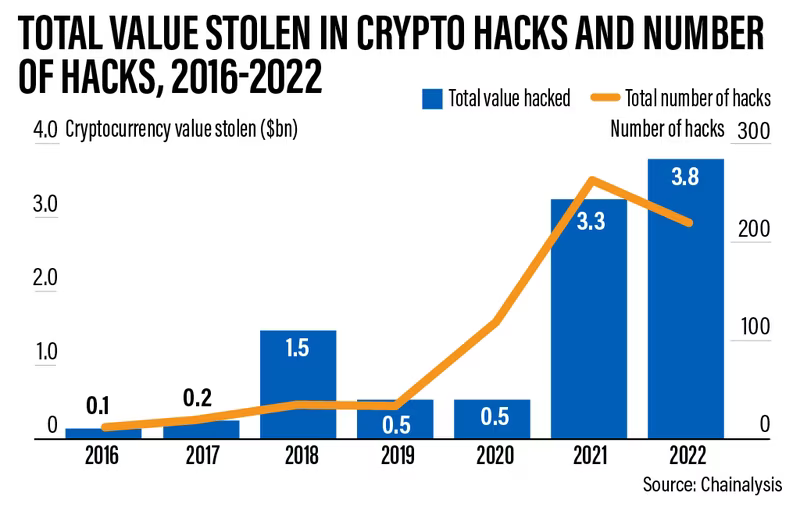

Smart contracts are not immune to vulnerabilities, and coding errors can lead to potential exploits. Hackers can identify and exploit vulnerabilities to manipulate the contract’s behavior, resulting in unauthorized fund transfers, loss of assets, or even the collapse of the entire platform. - High-Profile Smart Contract Hacks

The history of DeFi is marked by several high-profile smart contract hacks, leading to substantial financial losses. Examples include the infamous “DAO Hack” and the “bZx Flash Loan Exploits.” These incidents underscore the importance of rigorous security audits, ongoing code reviews, and robust testing before deploying smart contracts in a live environment.

As the DeFi ecosystem continues to evolve, understanding the risks associated with smart contracts is crucial for investors and participants to make informed decisions and take appropriate measures to mitigate potential vulnerabilities.

B. Market Risks

- Price Volatility of Cryptocurrencies

Cryptocurrencies, including those used within DeFi platforms, are known for their extreme price volatility. Sudden and significant price fluctuations can impact the value of assets held within DeFi protocols. Investors can experience both rapid gains and substantial losses due to market sentiment, external events, or speculative trading. This volatility can influence decisions regarding lending, borrowing, and trading activities. - Impermanent Loss in Liquidity Pools

Liquidity pools are a fundamental element of many DeFi platforms, allowing users to provide liquidity by depositing assets in exchange for rewards. However, impermanent loss occurs when the relative value of the deposited assets changes significantly compared to simply holding those assets. This loss occurs due to the dynamic nature of price changes and can impact the overall returns earned by liquidity providers. - Impact of External Factors on Token Values

The value of tokens within DeFi protocols can be influenced by various external factors, such as macroeconomic trends, regulatory developments, technological advancements, and market sentiment. Changes in the broader cryptocurrency market or unexpected events can lead to swift and dramatic shifts in token values, affecting the performance of DeFi investments.

We have seen $1.6B lost in the #crypto/#web3 world so far this year.

— CertiK (@CertiK) May 2, 2022

In just the first 4 months on 2022 we have passed the total amount lost in 2021 ($1.3B) and in 2020 ($516MM). https://t.co/jDohhaUYUN

C. Regulatory and Legal DeFi Risks

- Uncertainty Surrounding Regulatory Frameworks

DeFi operates in a regulatory gray area in many jurisdictions. The lack of clear and consistent regulations can create uncertainty for investors and users, making it challenging to assess the legal implications of participating in DeFi activities. Regulatory uncertainty can impact the long-term viability and adoption of DeFi platforms. - Potential Legal Implications for DeFi Users

Users participating in DeFi activities, such as lending, borrowing, and trading, might inadvertently run afoul of existing financial regulations. The lack of intermediary oversight does not necessarily exempt users from legal obligations. Depending on the jurisdiction, participants could face legal consequences, including fines or other penalties, if their activities are deemed non-compliant. - Examples of Regulatory Crackdowns

Several instances have highlighted regulatory crackdowns or interventions in the DeFi space. Regulatory authorities in different countries have taken actions against projects or platforms that were perceived as operating without proper licenses or violating financial regulations. These actions can result in disruptions to platform operations, asset freezes, and negative publicity, affecting investor confidence.

Navigating the complex landscape of market risks and regulatory uncertainties in DeFi requires a combination of research, risk assessment, and proactive monitoring. Investors and users should stay informed about both market trends and regulatory developments to make informed decisions and take appropriate measures to mitigate potential risks.

D. Governance Risks for DeFi

- Importance of Decentralized Governance

Decentralized governance is a core principle of many DeFi platforms, where decisions about protocol upgrades, parameter changes, and other critical matters are made collectively by the community of token holders. This approach aims to promote inclusivity, transparency, and fairness in decision-making, aligning the platform’s development with the interests of its users. - Centralization vs. Decentralization in Decision-Making

DeFi projects often face a delicate balance between decentralization and centralization. Over-centralization can lead to decisions that may not reflect the broader community’s preferences, while excessive decentralization can result in slow decision-making and inefficiencies. Striking the right balance is crucial to maintaining user trust and platform effectiveness. - Risks Associated with Malicious Governance Actions

Decentralized governance mechanisms can also be susceptible to malicious actions. Bad actors might accumulate tokens to gain disproportionate influence over decision-making, potentially leading to changes that benefit them at the expense of other users. This could involve approving harmful upgrades or exploiting vulnerabilities in the governance process.

E. Operational Risks

- Reliability of DeFi Platforms

The reliability of DeFi platforms is essential for user confidence and adoption. Platforms can face technical issues, bugs, or vulnerabilities that impact their functionality, leading to disruptions in trading, lending, and other activities. Ensuring a robust and secure technical infrastructure is crucial to maintaining the platform’s integrity. - Potential Downtime and Technical Issues

DeFi platforms operate in a highly dynamic and competitive environment, which can result in technical challenges, scalability concerns, and unexpected downtime. These issues can affect user experience, disrupt trading strategies, and lead to financial losses for participants. - User Error and Loss of Funds

The self-custodial nature of DeFi means that users are responsible for managing their private keys and interacting with smart contracts. Mistakes such as sending funds to incorrect addresses, misconfiguring transactions, or falling victim to phishing attacks can lead to irreversible loss of funds. User education, proper security practices, and caution are essential to mitigate such risks.

Navigating governance and operational risks in DeFi requires a comprehensive understanding of the platform’s governance mechanisms, technical infrastructure, and potential vulnerabilities. Engaging with the community, staying informed about governance proposals, and implementing robust security practices are key steps to mitigate these risks and ensure a safer and more productive DeFi experience.

Read : Best Practices for Promoting Web3 Services on Social Media

Read : Blockchain and B2B: Web3’s Role in B2B Business Models

Read : Top 20 Web3 Jobs: Frontier of Work in the Decentralized Internet

III. DeFi Risk Assessment Strategies

A. Research and Due Diligence

- Importance of Understanding Project Fundamentals

Thoroughly researching a DeFi project’s fundamentals is essential before getting involved. This includes understanding its purpose, underlying technology, use cases, and how it aims to solve real-world problems. A clear grasp of the project’s mission and objectives can help investors assess its potential for success. - Evaluating Project Team and Track Record

Assessing the project’s team members and their track record is crucial. Investigate their experience, expertise, and contributions to the blockchain and crypto space. A team with a proven history of successful projects and relevant expertise is more likely to deliver on their promises. - Analyzing Project Documentation and Whitepapers

Carefully review the project’s whitepaper and technical documentation. These documents should outline the project’s architecture, tokenomics, security measures, and use cases in detail. Scrutinize the technical feasibility of the project and its alignment with real-world needs.

B. Diversification

- Spreading Investments Across Different DeFi Platforms

Diversification is a key principle in risk management. By allocating investments across a variety of DeFi platforms and protocols, investors can reduce the impact of a single platform’s failure or underperformance. Diversification allows for exposure to different market segments, strategies, and potential sources of growth. - Mitigating the Impact of a Single Platform Failure

In the event of a failure or vulnerability in one DeFi platform, having investments spread across multiple platforms can help mitigate losses. While diversification doesn’t eliminate risks entirely, it can help limit the overall impact on an investor’s portfolio.

C. Security Audits

- Engaging Third-Party Security Firms for Code Audits

Before investing or participating in a DeFi project, ensure that the project’s smart contracts and code have undergone rigorous security audits. Engage reputable third-party security firms with expertise in blockchain and smart contract audits. These audits can identify vulnerabilities and potential risks, allowing the project to address them before deployment. - Importance of Transparent Audit Reports

Transparent audit reports provide insight into the vulnerabilities identified and the steps taken to address them. Investors should review these reports to gauge the project’s commitment to security and risk mitigation. Transparent communication about security measures enhances user trust and confidence. - Examples of Successful Security Audit Outcomes

Highlight instances where DeFi projects successfully passed security audits and subsequently demonstrated secure and reliable performance. These examples showcase the positive impact of thorough security assessments and can encourage investors to prioritize projects with proven security track records.

By employing these risk assessment strategies, DeFi enthusiasts can make informed investment decisions, reduce exposure to potential risks, and contribute to a safer and more resilient DeFi ecosystem.

IV. Role of Web3 MoJo Marketing Agency

A. Introduction to Web3 MoJo

Web3 MoJo Marketing Agency is a leading firm specializing in providing strategic support to projects within the decentralized finance (DeFi) ecosystem. With a team of experts in blockchain technology, security, and marketing, Web3 MoJo is committed to assisting DeFi enthusiasts and investors in navigating the complexities of the DeFi landscape.

B. Security Audits and Consultations

- How Web3 MoJo Assists Investors with Risk Assessment

Web3 MoJo plays a pivotal role in helping investors assess and manage risks associated with DeFi investments. Through in-depth research and analysis, the agency empowers investors with the knowledge needed to make informed decisions. By providing insights into potential risks, vulnerabilities, and market trends, Web3 MoJo enhances investors’ ability to evaluate opportunities effectively. - Offering Security Audits for DeFi Projects

One of Web3 MoJo’s core offerings is conducting thorough security audits for DeFi projects. By subjecting smart contracts and underlying code to rigorous scrutiny, the agency identifies vulnerabilities and potential exploits. This proactive approach helps projects rectify security issues before they can be exploited by malicious actors, enhancing the overall security posture of DeFi platforms. - Providing Expert Consultations on Risk Mitigation

Web3 MoJo goes beyond audits by offering expert consultations on risk mitigation strategies. The agency collaborates with project teams to develop robust security measures, governance structures, and risk management frameworks. By leveraging its industry expertise, Web3 MoJo assists projects in implementing proactive measures to safeguard against potential threats.

- The total value locked in DeFi protocols reached over $100 billion in early 2023. This growth has attracted a lot of attention from investors, but it has also made DeFi a target for hackers.

- In 2022, there were over 100 DeFi hacks and exploits, with losses totaling over $10 billion. This is a major risk for DeFi investors, and it is important to be aware of the risks before investing. Read More here.

- One of the most common DeFi risks is smart contract vulnerabilities. Smart contracts are the underlying code that powers DeFi protocols, and they can be vulnerable to hacks if they are not properly audited. Read More Here.

- Another common DeFi risk is impermanent loss. Impermanent loss occurs when the price of the underlying assets in a liquidity pool changes. This can result in investors losing money even if the overall value of the pool does not change.

- It is important to do your own research before investing in any DeFi project. This includes reading the white paper, understanding the risks involved, and conducting due diligence on the team behind the project.

V. Conclusion

In this comprehensive guide, we’ve explored the multifaceted landscape of risks within the decentralized finance (DeFi) ecosystem. We’ve delved into various risk categories, including smart contract vulnerabilities, market fluctuations, regulatory uncertainties, governance challenges, and operational issues.

Throughout the article, we’ve underscored the critical importance of informed decision-making when engaging in DeFi activities. DeFi enthusiasts and investors are encouraged to conduct thorough research, assess risks diligently, and implement risk management strategies to protect their investments and assets.

Encouragement for DeFi Enthusiasts to Stay Educated and Cautious

As the DeFi space continues to evolve, staying educated and cautious remains paramount. DeFi enthusiasts are encouraged to stay informed about the latest developments, technological advancements, and regulatory changes. By remaining vigilant and engaging with reputable resources, individuals can navigate the dynamic DeFi landscape with confidence.

In conclusion, by understanding and mitigating risks through strategies such as diversification, security audits, and expert consultations from agencies like Web3 MoJo, DeFi participants can position themselves for a more secure and rewarding experience in the decentralized financial ecosystem.

FAQs

Yes, DeFi is considered to be high risk. This is because DeFi protocols are still in their early stages of development, and they are not as well-regulated as traditional financial institutions. As a result, there is a higher risk of fraud, hacks, and other security vulnerabilities.

The biggest security risk in DeFi is smart contract vulnerabilities. Smart contracts are the underlying code that powers DeFi protocols, and they can be vulnerable to hacks if they are not properly audited. In 2022, there were over 100 DeFi hacks and exploits, with losses totaling over $10 billion.

Other security risks in DeFi include:

1. Key management: DeFi users are responsible for managing their own private keys, which can be lost or stolen.

2. Liquidity: DeFi protocols rely on liquidity pools to function, and if a liquidity pool becomes illiquid, it can be difficult for users to withdraw their funds.

3. Regulatory risk: DeFi is still in a legal gray area in many jurisdictions, and there is a risk that governments could crack down on DeFi protocols in the future.

In addition to security risks, there are also other risks associated with DeFi, such as:

1. Lack of regulation: DeFi is not regulated by any central authority, which means that there is no guarantee that investors will be protected if something goes wrong.

2. High volatility: The prices of DeFi tokens can be very volatile, which means that investors could lose money quickly.

3. Technical complexity: DeFi protocols can be complex and difficult to understand, which could lead to mistakes and losses.

4. Fraud: There have been cases of fraud in the DeFi space, such as rug pulls and honeypots.

The biggest problem in DeFi is the lack of liquidity. Liquidity is the ability to buy and sell assets quickly and easily, and it is essential for the functioning of DeFi protocols. However, many DeFi protocols are illiquid, which means that it can be difficult for users to withdraw their funds.

There have been a number of failures in the DeFi space, such as:

1. The DAO hack: In 2016, the DAO, a DeFi project, was hacked for $50 million. This was a major setback for the DeFi community and led to a loss of confidence in DeFi protocols.

2. The TerraUSD collapse: In May 2022, the TerraUSD stablecoin collapsed, wiping out billions of dollars in value. This was a major blow to the DeFi community and led to renewed concerns about the stability of DeFi protocols.

3. The Celsius Network freeze: In June 2022, Celsius Network, a major DeFi lending platform, froze withdrawals and transfers. This caused panic in the DeFi community and led to a sell-off in DeFi tokens.

DeFi could potentially be a threat to banks in the future. This is because DeFi protocols offer many of the same services as banks, but they are often more efficient and less expensive. As DeFi protocols continue to develop, they could become more popular and could eventually displace some traditional banks.

Yes, you can lose money on DeFi. This is because DeFi protocols are still in their early stages of development and are not as well-regulated as traditional financial institutions. As a result, there is a higher risk of fraud, hacks, and other security vulnerabilities.

In addition, the prices of DeFi tokens can be very volatile, which means that you could lose money quickly. If you are considering investing in DeFi, it is important to do your research and understand the risks involved